It’s possible to check credit score online via CIBI App. You don’t need to submit photocopies, or visit an office for an interview just to get your score!

You will do it online, and the verification call only takes 3-10 minutes. How convenient does that sound?

I did mine in 2020, and I will have another schedule in May 2021. I’ll tell you later on why I decided to have a second appointment. But please note that on my first virtual appointment, I was able to get my credit score immediately.

I even thought that the verification call would last up to 30 minutes but it was less than 10 minutes. If you haven’t tried it yet, do it now!

Related Articles: Financial Freedom

What is credit report and why do people need it?

In the USA or other countries, you will hear most people measuring their financial health through their credit score. Most of the time, the score is a basis whether you’re qualified for a big loan such as housing, auto or business.

In the Philippines, the credit score is not yet standardized. Not everyone knows their score, and it’s not the full basis of transactions.

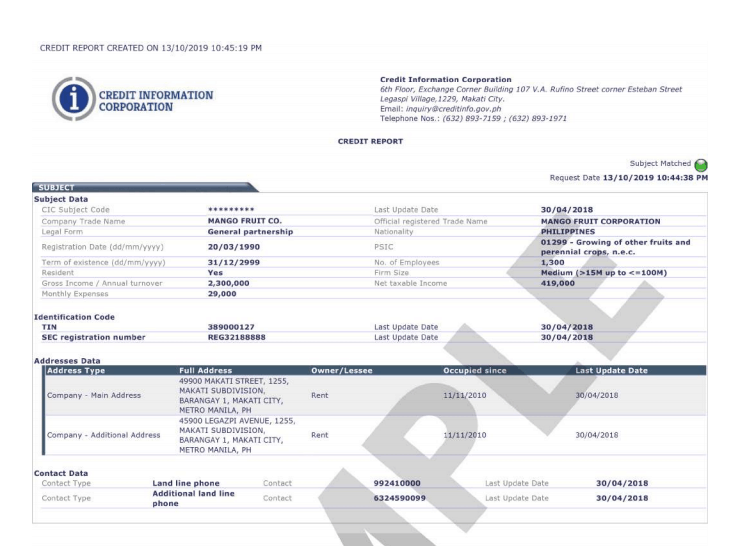

Credit Information Corporation (CIC) aims to make credit reports centralized in our country. They assess basic information and financial transactions since they’re authorized to collect these details.

So far, our country has three accredited bureaus:

- CIBI Information Inc

- CRIF Corporation

- TransUnion Information Solutions Inc.

Based on different groups on FB and Reddit, users have been concerned with their credit scores especially during the pandemic. Most of them requested for a copy to measure their abilities as a lender.

Why did I decide to check credit score online?

I asked for my credit report out of curiosity. It would be awesome to know which category I’d fall. The score is divided into four categories.

If your score is between 300-729, you fall under high risk category. Banks and other financial services will be cautious when dealing with you.

When you tried several services in the past and you’ve been a good payer, you might fall under medium risk (730-789) or low risk (790-829).

Of course, you’re luck to be part of the very low risk category. In this case, your score is between 839-900.

Everybody wants to receive a score between Low Risk and Very Low Risk. What does it mean? It shows that you’re a good payer, and that you can be trusted by banks for their loans.

So, I wanted to check if I could be trusted by the bank and other financial institutions.

What did I do to check my credit score online via CIBI app?

It’s very simple to get your credit report. Here are the steps you need to follow.

1. Download the CIBI App. Use your app to register for an account via Facebook, Gmail, or other email accounts. My first appointment is thru my Facebook account.

2. Verify your information. Once you created an account, you will be asked to verify your details by uploading your ID’s. Make sure to fill out every entry or answer questions to avoid delays.

3. Choose your schedule. Once you’re verified, you have to choose the schedule for your verification call. Remember that many people are interested in getting their score. This is why the calendar might be loaded. It can take 2-4 months before the next available date.

4. Add this appointment to your calendar. Please add it your calendar! Since you need to wait for months, it’s easy to miss this call. In case you’re not available due to an emergency, click “Reschedule”.

5. Attend the virtual meet up. You will receive a reminder of your appointment a day before the schedule. Download Google Meet Me and join the call immediately. If you’re scheduled for 9:00AM – 9:30AM meeting, be there at exactly 9:00AM. My interviewer was late for 5 minutes but I got instructions via email.

6. Pay for P235. After validating your identity, you will need to pay for P235. You can pay using debit or credit card.

7. Refresh and see your score. That’s it! Once payment is sent, you will see your score immediately. There’s also a PDF copy provided to your email.

CIBI MyScore Result

I was so excited to see the results. I’ve tried various services since 2016. Somehow, I felt like I’d been responsible with every payment.

When I opened the result, I was surprised to know that my score was…. ZERO. LOL. It means they’re not able to collect any data from me.

It was so funny yet surprising at the same time. Good thing they have what you call credit score dispute. If there are any discrepancies, you can file dispute to CIBI. Let’s say they declared an unpaid loan, you can email them and show your certificate of payment.

In my case, I don’t have any financial record so I had to dispute.

My greatest regret is that I should have added all banks or financial institutions. I only chose Metrobank, and added the others in the description.

This is why they only coordinated with Metrobank. The reason for my no records is my name.

Now, this answers why I have decided for a 2nd appointment. After the call, I’d file a dispute to my other banks.

Credit Score via CIBI App Tips

I think adults should try this even once. I mean, it’s interesting to get your own credit report. So if I have any tips, make sure that you follow these.

1. Mark your calendar and don’t miss the appointment. Rescheduling takes months.

2. File a dispute correctly. Enter each bank or financial institution per section.

3. If there are discrepancies, don’t hesitate to coordinate via email. CIBI email officers are very responsive.

4. Use your credit score wisely.

Watch: Related Video